When

balloons inflate, it is typically a long and slow process and always difficult

to tell when they are full. Towards the end, the balloon stretches and

stretches, making room for those last few short breaths. When you've

reached the end though, it just doesn't feel right and you start to think more

cautiously. Of course as we all know, balloons burst. Once that

magical maximum capacity is reached, the balloon POPS

in spectacular fashion, exploding with vigor - loudly and violently.

There

are three phases in the trajectory of the current fully-heated high yield

market: 1) Overbought conditions, 2) Rate tantrums, and 3) Defaults.

Overbought Conditions

Clearly we have been in "Overbought"

territory for quite some time. According to the BAML Master High Yield

Index, the average current high yield bond price is 104.10. The average

new issue clearing yield is 6.28%, down from 7.33% two years ago. In the

last year alone, the CCC new issue clearing yield has fallen from 8.77% to

7.79%. The average yield-to-maturity is 6.18%, down from 7.35% two years

ago.

Forward calendar volume is already

starting to reflect a small amount of hesitation in appetite, coming in at 19%

lower than this time last year. After growing rapidly over the past

10-15 years, high yield now comprises roughly 15% of the overall corporate

(investment grade) bond market, which itself is estimated at roughly $9.8

trillion, trailing the U.S. Treasury market ($12.1 trillion outstanding) but

larger than the municipal bond market ($3.7 trillion outstanding), according to

first-half 2014 estimates by industry trade group Securities Industry and

Financial Markets Association (SIFMA). In 1996, the high yield

market was $200 billion.

As

the market has grown and issuance has exploded, Cov-Lite, PIK and PIK-Toggle

issuance has had a resurgence, on pace to surpass the most recent highest

annual volume in 2008. PIKs

are viewed as more highly speculative debt securities. Essentially, the

company through in-kind payment is creating more debt in a situation where it

doesn’t have the capital to service the debt. This blatant disregard for

credit risk among the already obvious reach for yield is clearly setting up the

next default cycle.

Rate

Tantrums

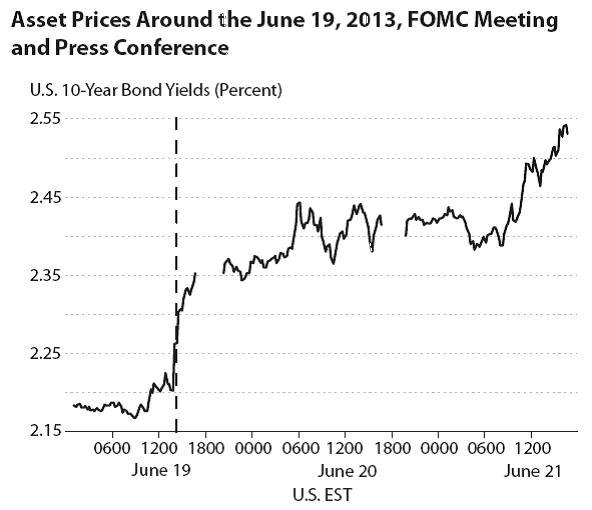

On

May 22, 2013, Former Fed Chairman Ben Bernanke announced that the Central Bank

would begin scaling back its monthly asset purchase program. This was

followed up with a June 19th press conference, where he optimistically

described then-current economic conditions, and reiterated that the taper would

commence later in 2013. In the next 48 hours, the 10Y Treasury yield rose

approximately 35 bps, from 2.20% to 2.55%. The 10Y Treasury yield hit 3%

by the end of 2013.

The

value of the USD vs other currencies also rose significantly on the

announcement, with some EM FX falling as much as 15-20% vs the USD. In

the four weeks following the May 22nd announcement, high yield ETFs and mutual

funds saw $12.3 billion in redemptions. This alarming outflow was only

recently surpassed by outflows in the July-August 2014 technical sell-off

($12.6 billion in outflows). Given that the Fed makes up approximately

90% of the new-issue MBS purchases, the reaction in the mortgage market was

even more violent. Annaly (NLY), a well-known mortgage REIT, lost 35% of

its value from the date of the announcement to the end of 2013.

The

stock market continued to show relative strength though, only selling off

approximately 5.5% in the month following the original announcement.

These collective reactions caused what is now referred to as "Taper

Tantrum".

The

nervousness in the market about a new and improved tantrum is starting to

become evident. Bloomberg reported caution from UBS and other market

participants last week. Larry Hatheway, UBS's Chief Economist said, “The main show is soon to

arrive. With the ‘taper’ nearly complete, there are fundamental and

institutional reasons aplenty to fret that last summer’s ‘taper tantrum’ will

be find its sequel. Beware ‘rate rage.’”. The Barron's this weekend is

calling for significant forthcoming volatility in the bond market, suggesting

that the announcement to raise rates may come as soon as the Fed's September

16th meeting. As US Treasury yields hit lows due to geopolitical concerns

and buying from sovereign debt relative value players, the rise could catch

many off-guard, despite pretty much everybody knowing in their heart that it's

coming.

Investors notoriously chase

returns. The St. Louis Fed recently wrote a paper on the dangers of

chasing returns (it was focused on equity mutual funds, but the premise holds

true), which pointed to a high correlation of flows to past returns, of course

resulting in inflows at exactly the wrong time. Despite the recent ETF

& mutual fund outflow hiccup in high yield, overall growth of the market

has been unprecedented since 2010. Some ETF operators have even caught on

to the fear of rising rates, putting together what the Barron's expects could

be a recipe for disaster - Long High Yield ETFs hedged with Short Treasuries.

(Although I agree that interest rates will rise over time, perhaps

significantly, in the fickle world of trigger-finger happy retail investors, at

the first sign of a risk-off environment these products could lose on both

sides of the trade. Investors thought all they were doing was protecting

their coupon, when in reality they were ignoring credit quality again.)

Defaults

Dr. Ed Altman, a world renowned

expert on corporate bankruptcy, is an advisor to our short-biased high yield

fund, and has conducted in depth research on the current credit bubble.

The current benign credit cycle, which has been near or below 2% for the

last five years, is expected to considerably increase over the next three to

five years. Without taking the currently fully heated credit environment

into account, it is clear that high yield default rates are incredibly

cyclical. The average annual default rate since 1971 is 3.14%, with below

average default cycles lasting three to four years typically, and above average

default cycles lasting one to two years. Any sustained period of

extraordinarily low defaults has typically been followed by a significant spike

in default rates.

The

corporate high yield sector has been refinancing and increasing their debt

significantly and consistently since the current benign credit cycle started in

2010. New high yield issuance topped $200 billion for the first time ever

in 2010. 2011 new high yield issuance was just below $200 billion, and

2012, 2013 and 2014 (the pace through the 1st half) have all topped $200

billion since.

Issuance

is unprecedented, and the quality of that issuance is clearly suspect, with CCC

issuance 21.5% of all high yield issuance, a figure not topped since 2008.

The 2nd quarter's CCC issuance jumped to 25.9% of total high yield

issuance, a figure only second to the all-time record in 2007. The

five-year cumulative mortality rate for CCC's is 47.4%, a sobering statistic

given the amount of low-rated debt issuance since 2010. 46% of the 1st

half high yield issuance was Cov-Lite, another factor which typically results

in lower recovery rates should the debtor company default. Dr. Altman's

well-known Z-Score metric, which quantifies a company's probability of default,

shows that the credit quality of companies in the peak of the current cycle is

lower than that of the last cycle peak in 2007.

Marty

Fridson's recent study suggested that the next default upsurge may be $1.576

trillion of face value between 2016 and 2020, a startling prediction given high

yield's lofty status, which on average continues to trade well above par.

The price of weak credits typically fall well before the default rate

spikes. As an example, we point to 2007 and 2008 where the default rate

was below 2% for every month except December 2008. By the time the big

spike in defaults occurred, the recovery (and QE) were already well in place.

Please

enjoy your Labor Day and be safe. I will be in NYC tomorrow for meetings

if you'd like to meet, and I'll be at Citi Field for a Goldman event on

Thursday (followed most likely by the US Open) if you'd like to catch up then.

We look forward to speaking with most of you in further detail about the

current opportunity set throughout the next few months.

Richard

Travia

Director

of Research

No comments:

Post a Comment