Hindsight is a wonderful thing. It is easy to go back, review past events and

to poetically postulate on what could happen next. The age of internet has given everyone the

power to quickly and easily refresh their memories. If that is the case, why are investors still

reaching for yield in the lowest rated junk bonds when they know how the story

will end? We have seen this story play

out before, and expect that it will again end badly.

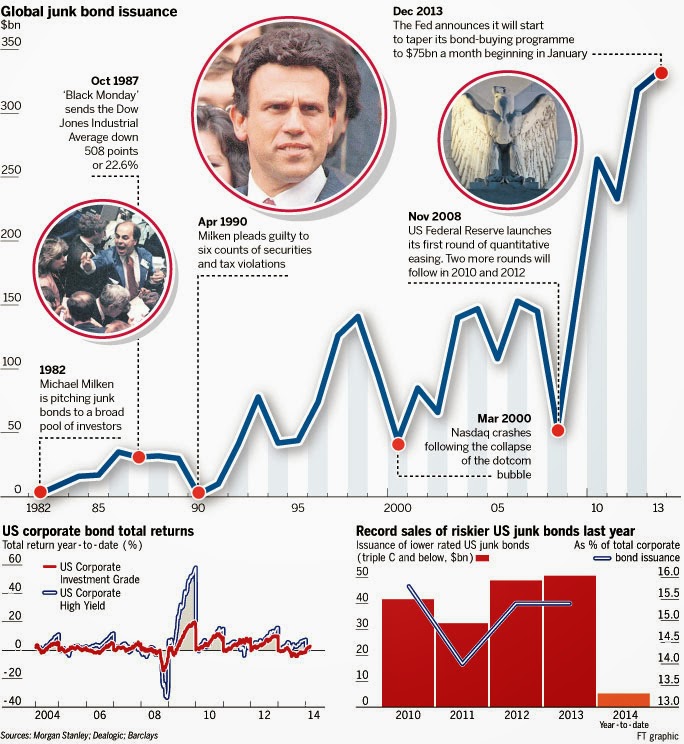

Michael Milken first started pitching junk bonds for the

masses in the early 80’s. Thirty years

later, the Fed has replaced Milken as one of the biggest supporters of junk

bonds thanks to 0% interest rates and easy money policies. Investors have appeared incredibly complacent

by owning this asset class without reservation; the same asset class that

always gets hit hard when a whiff of increased defaults comes to the fore. For now, money is still flowing into mutual

funds and ETFs that invest in junk bonds.

We have seen the pace starting to slow over the last three weeks though,

with $559 m of purchased high yield funds in the week ended February 26th,

which was proceeded by $804 m of inflows the week before and $1.45 b the week

before that.

After a year of abundant liquidity and near record setting

HY issuance, the HY default rate remained below historical averages and

decreased from 2012 to 1.04% (the 8th lowest rate since 1971). According to Ed Altman, sixty-four companies

with debt greater than $100 m filed for Chapter 11 bankruptcy protection in

2013, 7% less than in 2012. The number

of bankruptcies is less than the historical annual average of 75. Altman, Marty Fridson and many other well-known

prognosticators are starting to sound alarm bells, warning of an impending rise

in the default rate and bankruptcies.

While some investors have ignored these warning signs, Tradex has been

preparing.

We know, through the power of hindsight, that 45% of CCCs

default or restructure four years after issuance. After record issuance in 2012 and 2013 and an

inevitable spike in the default rate, Tradex will be ready. We will be short of the worst performing,

highly levered, subordinated junk bonds that benefitted from indiscriminate,

credit agnostic, yield-hungry buying. Michael

Milken’s run as “junk bond king” ended abruptly

with him spending two years in jail. We

don’t know exactly how the HY story will end this time around, but we

are pretty sure it will end badly.

Richard Travia

Director of Research

No comments:

Post a Comment