According

to RBS, retail investors now own an astounding 37% of the credit market.

This has grown from 29% in 2007, significantly in conjunction with the

growth of mutual funds and ETFs. As I have discussed in this blog over

the last few weeks, the liquidity in the market has not kept pace with the

relentless demand for yield. Off the charts issuance in the primary

market has created a complete misconception about perceived liquidity in the

secondary market, where high yield bonds actually trade.

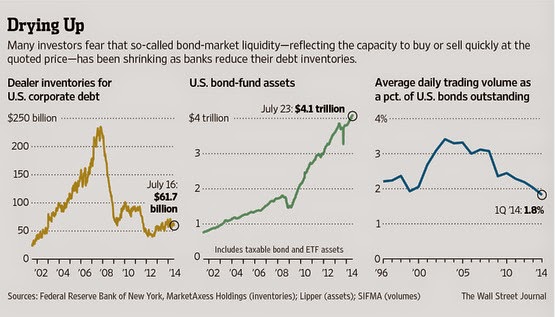

While

US bond fund assets have grown from approximately $1 trillion in 2003 to nearly

$4.1 trillion today, dealer inventory has fallen off a cliff. Peak

inventory in early 2008 was nearly $250 billion. Today, US corporate

dealer inventory is $61.7 billion, with average daily trading volume in US

corporates dipping below 2% of all outstanding debt for the first time since

the late 1990's. Specifically, high yield corporate inventory fell to

$4.8 billion in early July, the lowest level since the Fed started publishing

this data in April 2013.

Banks

have been forced to eliminate or repurpose most of their prop-desks and their

risk-taking activities have been largely curtailed. Post 2008 crisis,

banks now face must stricter capital requirements, where the appetite to hold

the riskiest securities on their balance sheet is suppressed. Market

participants are finding out fast that the bid is difficult to hit when selling

bonds, even in small size.

For

the week ended August 6th, investors pulled a record $7.1 billion from US junk

bond mutual funds and ETFs. In the last four weeks, the redemptions have

totaled $12.6 billion, trumping the $12.3 billion pulled in Q2-2013's

"taper tantrum". The high yield bond market, which typically

trades with a very high correlation to the stock market, is starting to

diverge. The overheated credit market and its growing bubble have now

gotten the attention of the media, with daily headlines suggesting caution.

With interest rates set to move higher, taper almost complete and QE

being wound down, high profile investors and economists are letting themselves

be heard by sending out warnings. Corporate bankruptcy expert, Dr. Ed

Altman, published research earlier this week which discusses the nature and

risks in the current credit bubble. For full disclosure, Dr. Altman is an

advisor to our Fund.

Let

us also not forget the following: 1) There are serious military actions

occurring in the Middle East as we speak - that the US is now involved in, 2)

several airplanes carrying innocent civilians have recently either mysteriously

disappeared or have been shot down, 3) the Fed recently announced that

inflation is unlikely to continue running below the 2% target, 4) the 2nd

largest bank in Portugal just effectively collapsed, and 5) Argentina just had

its 2nd technical default in the last 15 years. In the summer of 2011

(the last real market correction), the S&P 500 fell nearly 20%, primarily

on a spike in anxiety about Europe's ongoing sovereign debt crisis,

specifically with Greece teetering on the edge of default, and the US

government's inability to agree on the debt ceiling, which ultimately resulted

in a credit rating downgrade.

We

are facing an environment where market technicals can turn very quickly, both

for the positive and negative. While I have consistently written about,

and discussed with most of you, that the poor fundamental health in many of the

B and CCC-rated bonds we are short of will be the ultimate driver of downward

bond prices, the technical considerations in the market are quite important and

compelling today. I urge investors to seriously consider adjusting their

exposures, to be proactive rather than reactive and to take advantage of the

asymmetry present in being short high yield today.

Enjoy

your Sunday. I'm in the Pocono Mountains with my in-laws - fishing,

playing with the dog, watching the kids play, but thinking about high yield

bonds!!!

Richard Travia

Director of Research